Traditionally, most couples going through a divorce did it with the help of lawyers. The husband and the wife would each hire their own attorney to guide them through the process and help with the necessary calculations and divisions of property. But a change is brewing. More and more, people are using the resources at their disposal to navigate the legal process themselves.

It’s easy to see why this is becoming a popular option. Divorce is an incredibly intimate process that tends to touch on the most private aspects of people’s lives. Bringing in complete strangers, even if they are lawyers, can be uncomfortable and invasive. And it’s expensive. A typical divorce usually costs each party several thousand dollars in attorneys’ fees alone. And while most lawyers are good, decent people – there are some who will amplify the disputes just to drive your costs up and increase their bottom line.

On top of all that, there are a number of great resources out there for people trying to handle their own divorce. The Montana Supreme Court supplies forms for all the documents you will need to file in Court to process your divorce. You can find them online at this link. You’ll need to pick the proper packet depending on whether you have minor children and whether you and your soon-to-be-ex will be doing it together. If that’s the case, it’s called a “Summary Dissolution.”

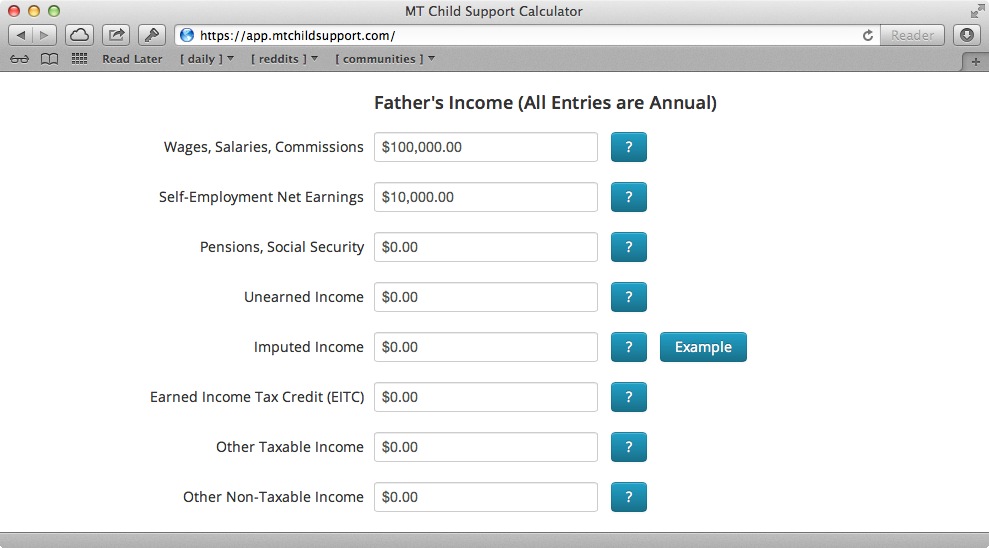

If you have minor children, the law requires that you also provide a child support calculation with your paperwork to the Court. It can be done by hand, and the Child Support Enforcement Division has done a great job of making it as easy as possible to do this way. But it’s still a long and complicated process. And making any changes requires doing the entire thing over again. For years, lawyers have had access to software able to do the calculations for them. Now, you can have the same thing. By using the Montana Child Support Calculator, you can automatically calculate as many calculations as you like. Choose the best result and you’re all set. The program creates printable versions of the appropriate paperwork to file with the Court.

It’s getting easier and easier to handle your divorce yourself. But it’s important to do it right, and one of the best ways to do that is to use the resources at your disposal. Use the proper forms and take advantage of the child support calculator. Doing it yourself can be smart. But there’s no reason to make it harder than necessary.