Creating a good child support calculation means providing as much information as possible. That’s why we recommend having previous income tax returns and W-2s for both you and the other parent when you’re creating one. But let’s face it, that’s not always possible. Sometimes you just have to make due with what you’ve got. Well today we’re proud to announce that we can help you do a little more with what you have.

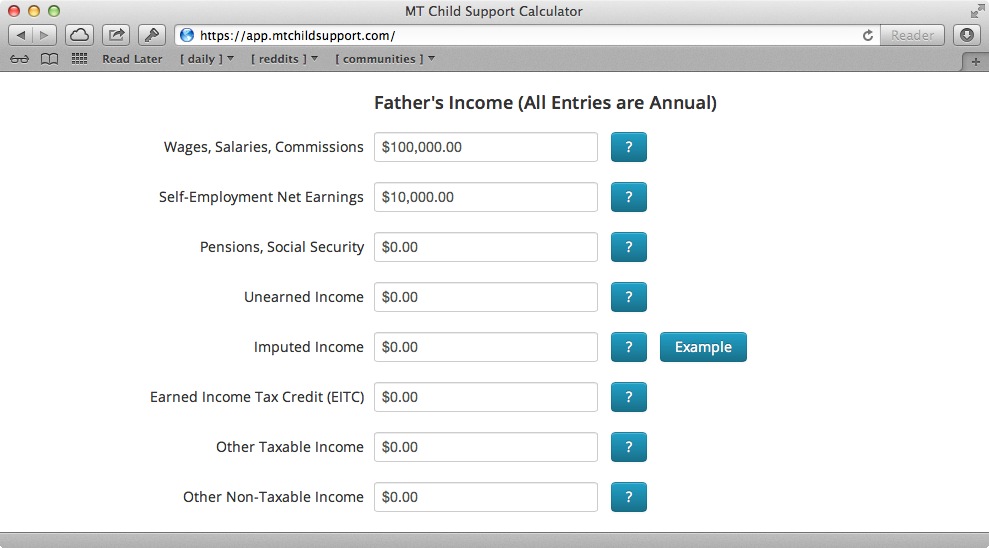

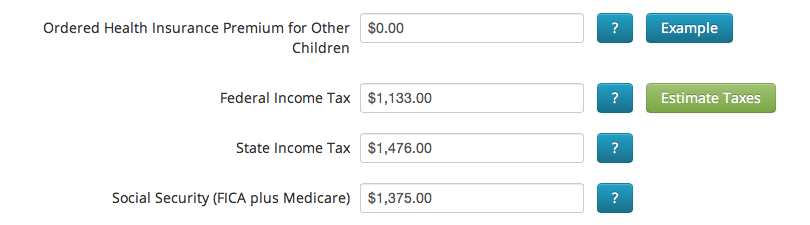

An often overlooked aspect of the child support guidelines is that they allow estimations of tax in cases where that information is not available. So, for example, if your other parent is being uncooperative or you’re just trying to create a calculation with the information you have on hand. The estimation process uses some complicated IRS formulas and tax tables to come up with a decent approximation of what your other parents might owe. Here at the Montana Child Support Calculator, it didn’t make a lot of sense to us that we’d do the math on the calculation for you – but leave you high and dry when it came to the calculations. So we rolled up our sleeves and made the whole process automatic. Now, just click the “Estimate Taxes” button for either the mother or the father, and we’ll take care of the rest. Just enter as much information as you know about their income and other expenses. One thing to be aware of, if you’ve entered any information for their Federal Income, State Income, SS, or EITC – doing this will wipe that out and replace is with our estimates.

An often overlooked aspect of the child support guidelines is that they allow estimations of tax in cases where that information is not available. So, for example, if your other parent is being uncooperative or you’re just trying to create a calculation with the information you have on hand. The estimation process uses some complicated IRS formulas and tax tables to come up with a decent approximation of what your other parents might owe. Here at the Montana Child Support Calculator, it didn’t make a lot of sense to us that we’d do the math on the calculation for you – but leave you high and dry when it came to the calculations. So we rolled up our sleeves and made the whole process automatic. Now, just click the “Estimate Taxes” button for either the mother or the father, and we’ll take care of the rest. Just enter as much information as you know about their income and other expenses. One thing to be aware of, if you’ve entered any information for their Federal Income, State Income, SS, or EITC – doing this will wipe that out and replace is with our estimates.

The rules allow you to use this any time you don’t have more accurate information, but we advise you to use it wisely. Remember, the best calculation is the most accurate calculation. And the most accurate calculation is the one based on the best information. Estimation is a vital tool for lots of people needing child support calculations. But it shouldn’t necessarily be your first response.

We’ll continue to make creating Montana Child Support Calculations as easy as possible, and (hopefully) you’ll keep using us to create them. Thanks everyone for all the support we’ve received.