In one way, the Montana Supreme Court has very little to do with child support. But, on a larger scale – they’ve got everything to do with it. I’ll try to explain that better, but first – let’s talk about the make up of courts in Montana.

Our judicial system is made up of different levels of Courts. Generally, it’s easiest to think of them in terms of the size of the area they represent. So first we have city courts. Not all towns across Montana have them, but you’ll find them in the incorporated cities of our state. They’re the smallest courts because they’re jurisdiction is limited to city limits. There are a number of other limitations on city courts, but the most important one for our purposes today is that they can’t hear child support issues. In fact, they can’t make decisions regarding family law matters at all (except orders of protection, but that’s not really family law).

The next step up is Justice Courts. Montana Justice Courts are tied to counties. Usually they’re found in the county seat (although there are a few exceptions) and they deal with smaller civil and criminal matters. So, for example: the longest that you can be sentenced for a criminal violation in justice court is 6 months. If the charge has a possible penalty beyond that, then things move up to District Court. Just like city courts, justice courts have no jurisdiction over family law – so child support matters are not dealt with there.

The largest trial courts we have in Montana are the District Courts. Again, they are tied to counties, but they hear anything and everything. Although the other courts have a limit on how big of cases they can hear, District Court has no such limit. And, interestingly, it’s got no limit they other way. District Courts can hear the biggest cases, and the smallest cases. And, they are the only trial courts in the state with jurisdiction over child support matters and other family law issues. If you are bringing a child support claim in Montana (in court) you have to do it in District Court.

And now, we finally get to the Montana Supreme Court. Although the District Court’s have original jurisdiction over child support cases (that’s where they start) the Supreme Court has the power to review any decisions made by any courts in the state. This does NOT mean that you can have your child support hearing all over again at the Supreme Court, but it does mean that the Supreme Court can review the record and the decisions made by the District Court – and examine it to see if any mistakes of law were made.

The Supreme Court makes the ultimate decisions on interpreting law and the constitution. They’re the ones who decide what all the guidelines really mean. And when they make a decision about what it means, everyone is bound by that decision going forward. So, getting back to what I said originally – the Supreme Court has very little to do with Child Support because they won’t be making the decisions about your case. But they have everything to do with it, because they’ve been handing down rulings for years and years that tell us what the guidelines really mean and what the right way to go about doing the calculations is. And, if the District Court makes a mistake in your case – the Supreme Court can correct it on appeal.

Many people using our online child support calculator are doing it because they are representing themselves in a divorce, child custody, or child support matter in Court. For most people, going in to Court unrepresented is an intimidating and difficult thing. Luckily, Montana has the Self Help Law Program, with offices across the state.

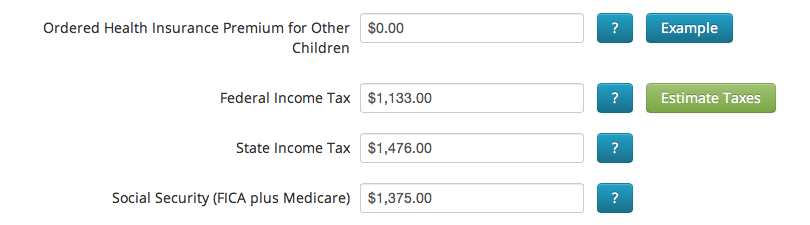

Many people using our online child support calculator are doing it because they are representing themselves in a divorce, child custody, or child support matter in Court. For most people, going in to Court unrepresented is an intimidating and difficult thing. Luckily, Montana has the Self Help Law Program, with offices across the state. An often overlooked aspect of the child support guidelines is that they allow estimations of tax in cases where that information is not available. So, for example, if your other parent is being uncooperative or you’re just trying to create a calculation with the information you have on hand. The estimation process uses some complicated IRS formulas and tax tables to come up with a decent approximation of what your other parents might owe. Here at the Montana Child Support Calculator, it didn’t make a lot of sense to us that we’d do the math on the calculation for you – but leave you high and dry when it came to the calculations. So we rolled up our sleeves and made the whole process automatic. Now, just click the “Estimate Taxes” button for either the mother or the father, and we’ll take care of the rest. Just enter as much information as you know about their income and other expenses. One thing to be aware of, if you’ve entered any information for their Federal Income, State Income, SS, or EITC – doing this will wipe that out and replace is with our estimates.

An often overlooked aspect of the child support guidelines is that they allow estimations of tax in cases where that information is not available. So, for example, if your other parent is being uncooperative or you’re just trying to create a calculation with the information you have on hand. The estimation process uses some complicated IRS formulas and tax tables to come up with a decent approximation of what your other parents might owe. Here at the Montana Child Support Calculator, it didn’t make a lot of sense to us that we’d do the math on the calculation for you – but leave you high and dry when it came to the calculations. So we rolled up our sleeves and made the whole process automatic. Now, just click the “Estimate Taxes” button for either the mother or the father, and we’ll take care of the rest. Just enter as much information as you know about their income and other expenses. One thing to be aware of, if you’ve entered any information for their Federal Income, State Income, SS, or EITC – doing this will wipe that out and replace is with our estimates.